Fidelity growth equity fund images are ready. Fidelity growth equity fund are a topic that is being searched for and liked by netizens now. You can Find and Download the Fidelity growth equity fund files here. Find and Download all free photos.

If you’re looking for fidelity growth equity fund images information connected with to the fidelity growth equity fund keyword, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

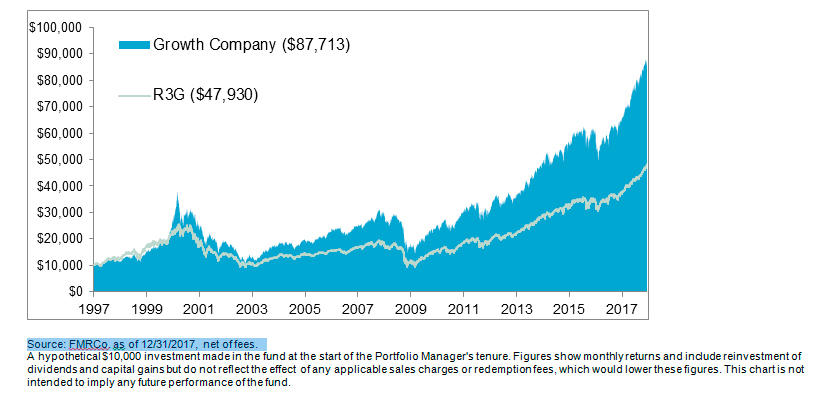

Steve Wymer has been at the helm of FDGRX since 1997 producing an impressive 13 annualized return in that time. This is another aggressive Fidelity fund with a long manager tenure. FIDELITY GROWTH OPPORTUNITIES ETF 20984 00641 03064 AS OF 41001pm ET 02122021 Quotes delayed at least 15 minutes. That compares to 1020 on the Russell 3000 index during the same period. Fidelity Growth Company has the same outstanding manager and well-executed process but gets a Morningstar Analyst Rating upgrade to Gold for its cheaper K share class.

Fidelity Growth Equity Fund. It will generally invest in equity securities of domestic companies but may also invest in equity securities of foreign companies and American Depositary Receipts ADRs. Steve Wymer has been at the helm of FDGRX since 1997 producing an impressive 13 annualized return in that time. Normally investing primarily in common stocks. Fidelity International Growth Fund FIGFX seeks long-term appreciation of capital and invests primarily in foreign securities including securities of companies from emerging markets.

The 5 Best Fidelity Stock Funds To Buy For The Long Term Kiplinger From kiplinger.com

The 5 Best Fidelity Stock Funds To Buy For The Long Term Kiplinger From kiplinger.com

Commissions fees and expenses may be associated with investment funds. It invests primarily in common stocks. Strategy Normally investing at least 80 of assets in equity securities. Analyze the Fund Fidelity Advisor Series Equity Growth Fund having Symbol FMFMX for type mutual-funds and perform research on other mutual funds. It invests primarily in common stocks. This is another aggressive Fidelity fund with a long manager tenure.

Fidelity International Growth Fund FIGFX seeks long-term appreciation of capital and invests primarily in foreign securities including securities of companies from emerging markets.

That compares to 1020 on the Russell 3000 index during the same period. The Fund seeks to achieve capital appreciation by investing in at least 65 of assets in common stocks with strong growth potential characteristics. Under normal market conditions the fund invests at least 80 of its net assets plus any borrowings for investment purposes in equity securities. Steve Wymer has been at the helm of FDGRX since 1997 producing an impressive 13 annualized return in that time. That compares to 1020 on the Russell 3000 index during the same period. It invests in companies that the advisor believes have above-average growth potential stocks of these companies are often called growth stocks.

Source: forbes.com

Source: forbes.com

Under normal market conditions the fund invests at least 80 of its net assets plus any borrowings for investment purposes in equity securities. The fund invests in companies the advisor believes have above-average growth. This is another aggressive Fidelity fund with a long manager tenure. Analyze the Fund Fidelity Advisor Series Equity Growth Fund having Symbol FMFMX for type mutual-funds and perform research on other mutual funds. FIDELITY GROWTH OPPORTUNITIES ETF 20984 00641 03064 AS OF 41001pm ET 02122021 Quotes delayed at least 15 minutes.

Source: businesswire.com

Source: businesswire.com

It invests primarily in common stocks. Investment market cap and category. Commissions fees and expenses may be associated with investment funds. The fund invests in companies the advisor believes have above-average growth. Investing in companies FMR believes have above-average growth potential stocks of these companies are often called growth stocks.

Source: investorplace.com

Source: investorplace.com

The fund invests in domestic and foreign issuers. The fund normally invests at least 80 of its assets in equity securities. The Fund seeks to achieve capital appreciation by investing in at least 65 of assets in common stocks with strong growth potential characteristics. Under Morningstars enhanced ratings methodology these advantages lead to its two least-expensive share. FBCGX Blue-chip stocks could be attractive for a buy-and-hold strategy if youre interested in companies with outstanding growth potential.

Normally investing primarily in common stocks. Fidelity Funds cover all asset classes of mutual funds from domestic equity to specialized sectors so you can find the mix of funds that helps you to achieve your strategic investment goals. The fund normally invests at least 80 of its assets in equity securities. Find our live Fidelity Japan Growth Equity Fund fund basic information. It invests primarily in common stocks.

Steve Wymer has been at the helm of FDGRX since 1997 producing an impressive 13 annualized return in that time. Fidelity International Growth Fund FIGFX seeks long-term appreciation of capital and invests primarily in foreign securities including securities of companies from emerging markets. Fidelity Funds cover all asset classes of mutual funds from domestic equity to specialized sectors so you can find the mix of funds that helps you to achieve your strategic investment goals. Fidelity Growth Company FDGRX. The Fund seeks to achieve capital appreciation by investing in at least 65 of assets in common stocks with strong growth potential characteristics.

Fidelity International Growth Fund FIGFX seeks long-term appreciation of capital and invests primarily in foreign securities including securities of companies from emerging markets. Under Morningstars enhanced ratings methodology these advantages lead to its two least-expensive share. Fidelity Growth Company has the same outstanding manager and well-executed process but gets a Morningstar Analyst Rating upgrade to Gold for its cheaper K share class. FBCGX Blue-chip stocks could be attractive for a buy-and-hold strategy if youre interested in companies with outstanding growth potential. Find our live Fidelity Japan Growth Equity Fund fund basic information.

Source: fidelity.com

Source: fidelity.com

Investment market cap and category. The fund invests primarily in common stocks. Generally data on Fidelity mutual funds is provided by FMR LLC Morningstar ratings and data on non-Fidelity mutual funds is provided by Morningstar Inc. The Fund invests in Fidelity North American Equity Investment Trust the Underlying Fund which invests primarily in equity securities of companies located in Canada andor the United States. The Fund seeks to achieve capital appreciation by investing in at least 65 of assets in common stocks with strong growth potential characteristics.

Source: fidelity.com

Source: fidelity.com

That compares to 1020 on the Russell 3000 index during the same period. It invests primarily in common stocks. The fund invests in companies the advisor believes have above-average growth. The fund normally invests at least 80 of its assets in equity securities. This is another aggressive Fidelity fund with a long manager tenure.

Source: kiplinger.com

Source: kiplinger.com

Under Morningstars enhanced ratings methodology these advantages lead to its two least-expensive share. It invests primarily in common stocks. Commissions fees and expenses may be associated with investment funds. And data on non-mutual fund products is provided by the products investment manager trustee or issuer or the plan sponsor whose plan is offering the product to participants. FBCGX Blue-chip stocks could be attractive for a buy-and-hold strategy if youre interested in companies with outstanding growth potential.

Source: morningstar.com

Source: morningstar.com

It invests primarily in common stocks. It invests primarily in common stocks. The fund normally invests at least 80 of its assets in equity securities. That compares to 1020 on the Russell 3000 index during the same period. Analyze the Fund Fidelity Advisor Series Equity Growth Fund having Symbol FMFMX for type mutual-funds and perform research on other mutual funds.

FBCGX Blue-chip stocks could be attractive for a buy-and-hold strategy if youre interested in companies with outstanding growth potential. Its pricier no-load shares. The fund invests in companies the advisor believes have above-average growth. Steve Wymer has been at the helm of FDGRX since 1997 producing an impressive 13 annualized return in that time. This is another aggressive Fidelity fund with a long manager tenure.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fidelity growth equity fund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.